How to Review a Mortgage Statement

When was the last time you reviewed your mortgage statement? Like most documents that have become paperless over the past decade, they can easily be tossed aside or dragged into your email’s trash folder each month. Although a mortgage statement may seem dull and solely quantitative, I believe it reveals a unique story that goes beyond the numbers.

Together, we will review a real mortgage statement to discover valuable planning opportunities you may not have previously considered. You may pull up your own statement or simply download our Mortgage Statement Template to follow along. Since mortgage statements now follow a standardized model, yours will include similar information to our template.

Lender and Borrower Basics

At the top of the statement, we find the mortgage servicer’s contact information, the statement closing date, and the property address for the home secured by the loan. A mortgage is considered secured because the property itself serves as valuable collateral in the event of loan default – a failure to meet the legal repayment obligation. Since secured loans are backed by tangible assets and expose the lender to less risk, they tend to offer lower interest rates than unsecured debt, such as credit cards. The statement also includes the loan number, the upcoming payment amount, and its due date. Unlike the statement closing date, when the monthly interest charges are calculated, the due date (usually 20-25 days later) is when your next minimum payment is due without incurring late fees.

Account Information

The outstanding principal balance is the remaining loan balance as of the statement closing date. Since interest accrues over time, your actual payoff amount may differ from the outstanding balance shown and must be requested by contacting your mortgage servicer. When your mortgage is paid in full, you will receive a loan payoff confirmation letter, one of the few pieces of mail you will be excited to open (and frame)!

The maturity date is when your loan is expected to be fully repaid if only minimum monthly payments are made. If you make additional principal payments, the loan will be satisfied earlier than this date.

The interest rate is the annual cost of borrowing. Each billing cycle, your interest rate (divided by 12 months) is multiplied by your outstanding principal balance to determine the portion of your monthly payment allocated to interest (vs. principal).

Below is a breakdown of a 30-year mortgage with a 3% fixed interest rate. Since the outstanding principal balance is naturally largest at the beginning of the debt repayment period, more than half of the loan’s total interest is paid within the first third of its lifespan. Notice that the principal portion of the fixed payment does not exceed the interest portion until the beginning of year 8, and the total payments made are more than 50% higher than the original mortgage amount. With a 15-year mortgage, the principal portion exceeds the interest portion every month.

Explanation of Amount Due - Payment Breakdown

As previously mentioned, each monthly mortgage payment covers a portion of the loan’s principal and interest accrued since last month’s statement. Principal is the portion of your payment that reduces the outstanding loan balance as you move closer to the maturity date.

You may also make payments into an escrow account, which is essentially a forced savings account that allows your mortgage lender to disburse property tax payments and home-related insurance premiums on your behalf.

Combining the monthly payment amounts: Principal (P), Interest (I), Taxes (T), and Insurance (I), multiplying by 12 months per year, then dividing by gross household income, we can calculate a well-established housing debt-to-income ratio. An industry benchmark states that the annual PITI payments should not exceed 28% of gross income. Applying this ratio to our mortgage statement template, PITI is $3,631.33 per month = $43,575.96 per year. Therefore, this household’s annual gross income should stay above $155,628 to remain within the 28% threshold.

Adding all other annual debt payments, such as auto and student loans, you can also determine your total debt-to-income ratio. This amount should stay within 36% of gross income to meet the industry’s standard for reasonable debt.

PITI ≤ 28% of Gross Income

PITI + Other Debt Payments ≤ 36% of Gross Income

Calculate and discuss these ratios with your family, then consider establishing your own rules of thumb for healthy leverage. Would you prefer to keep all debt payments within 25% of gross income or use net income (excluding income taxes) within your preferred formula?

Your mortgage lender may require that you make private mortgage insurance (PMI) payments if you have a conventional loan and less than 20% equity in your home. This insurance coverage protects your lender if you stop making payments on your loan. There are two ways to eliminate PMI: (1) Make additional payments to increase home equity or (2) Request an appraisal to reevaluate the value of your home. With increased home prices, I recently requested an external appraisal for $100 and eliminated $3,000 of future PMI payments! Contact your loan servicer to request an equity valuation.

More About Escrow

Escrow payments cover your anticipated property taxes and home-related insurance premiums, spread across your 12 monthly payments to ensure you are on track to cover your expenses when they come due. Since these future payments are estimated, you may own more or less when the bills arrive, called an escrow shortage or overage. You can look up your tax payment history by initiating a property search on your county’s appraisal district website. Whether you have an escrow account depends on the type of mortgage, your equity percentage, and your payment history. Government-backed FHA and USDA loans require an escrow account, whereas conventional loans may have unique requirements per mortgage servicer. Inform your servicer if you would prefer to save for these expenses on your own. Consider earmarking anticipated tax payments and insurance premiums in a separate savings account if you don’t pay into an escrow account. Since these funds will be spent within one year, they have an investment objective of stability and liquidity, not growth and income. And since the expenses are anticipated (not unexpected), these funds should not commingle with your emergency fund.

Analyzing the Mortgage

Outstanding Principal: $492,374.59

Interest Rate: 2.875%

Principal Payment: $894.81

Interest Payment: $1,179.65

Using a financial calculator and fundamental time value of money (TVM) principles, we can turn these numbers into a meaningful conversation. I love using the “10bii Calculator” phone app, and here is a free online TVM calculator. Since we are manually entering monthly values, ensure that your calculator assumes one payment per period.

Referencing our statement template, we enter the following mortgage information into the calculator:

Interest Rate (I) = 2.875 / 12 (since there are twelve equal payments per year)

Present Value (PV) = $492,374.59 (the outstanding principal value, as a positive number since we received the loan as an inflow)

Payment (PMT) = -$2,074.46 (the combined monthly principal and interest payments, as a negative number since payments are outflows)

Future Value (FV) = $0 (since we want to fully pay off the loan)

Number of Periods (N) = ? (the number of monthly payments remaining)

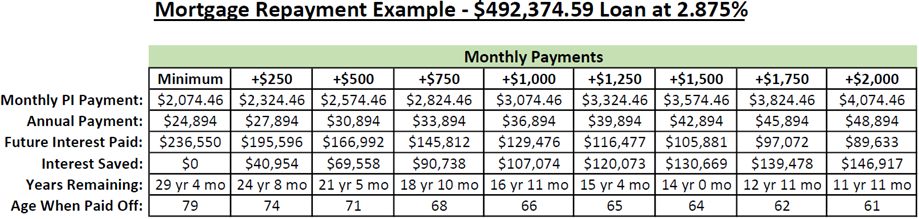

The number of periods (N) comes to 351.4, meaning we will need to make 352 monthly payments to pay off the loan. Dividing by 12 equals 29.333, meaning 29 years and 4 months is the remaining repayment period if only minimum payments are made.

Using the amortization feature on a financial calculator, we can also determine that $236,550 will be paid in future interest, bringing the total future cost of the mortgage to $728,925.

Now that you know how to use your calculator like a pro, here is an easier version to try out your own numbers:

What if we wanted to pay off this mortgage within the next 20 years instead? We would simply use the following TVM formula to determine the required monthly payments since we know the desired number of periods:

Number of Periods (N) = 240 (20 years * 12 months per year)

Interest Rate (I) = 2.875 / 12 (since there are twelve equal payments per year)

Present Value (PV) = $492,374.59 (the outstanding principal value, as a positive number since we received the loan as an inflow)

Future Value (FV) = $0 (since we want to fully pay off the loan)

Payment (PMT) = ? (the required monthly payments, as a negative number since payments are outflows)

The calculation results in a required monthly payment of $2,700 = $32,400 per year for the next 20 years, paying almost $81,000 less interest (-34%) than our previous example but increasing the monthly principal payments by $625 ($7,500 per year).

Here is a visual analysis of how additional principal payments can reduce the debt repayment period in alignment with other age-based planning opportunities. In this example, the borrower is age 50 and on track to pay off the mortgage by age 79 without making additional principal payments. If $500 extra is paid per month, the repayment period is reduced by nearly 8 years!

Using this exercise, we can reveal the quantitative (data-driven) and qualitative (personal) outcomes of different debt repayment scenarios. Would you like to have your mortgage paid off before retirement to reduce future income needs? Or are you comfortable paying off your mortgage minimally so you can use current cash flow for other spending and investment opportunities?

Think about money in terms of time, giving every dollar a use-by date.

Payment Options

A payment coupon is attached to the statement to be mailed alongside your payment. I wish this coupon provided a discount! Your mortgage servicer will also offer an online payment option, including auto-pay from a checking account if you want to simplify payments. If your payment exceeds the amount due, you must indicate how the excess should be applied, either to future monthly payments to get ahead or additional principal payments to shorten the debt repayment period.

How to Measure Twice® and Keep Finance Personal®

Visit your county’s appraisal district website and initiate a property search to view your home’s titling information, land vs. homesite value, appraised vs. assessed value, and current exemptions. The rolling value history can clarify annual changes and caps on your home’s assessed value and property tax payments. Determine if your mortgage interest and property tax payments provide any income tax benefits by itemizing deductions.

Introduce thoughtful family conversations about future up- or downsizing as you align your money with your personal objectives moving forward. If you are thinking about buying a home, also understand the true costs of homeownership that go beyond the monthly mortgage payments. Continue to discover unique financial planning opportunities through your review of financial documents, and go beyond the numbers!